The interim CEO of a prestigious Ohio-based orthopedic group, spanning six locations with a team of 33 doctors, had just finished his H12023 performance review with his core team. And there were more questions than answers after a two-hour meeting.

The team faced a perplexing puzzle. Average monthly visits were in line, the staff were clocking full hours, the eClinical Works PMS was recently upgraded, and he had even negotiated a favorable clearing agency contract too. Yet, the financials were not adding up.

Despite operational efficiency and recent system upgrades, the group faced increasing Accounts Receivable (AR) days, rising denial rates, and declining monthly reimbursements. Key concerns included a 28% increase in AR days > 90, a denial Turn-Around Time (TAT) exceeding 11 days, and a monthly reimbursement rate 8% lower than H₁ FY2022. The dream of expanding to two more locations by Q4 2023 was slipping away.

Challenge:

The primary challenge was to rectify the financial trajectory without disrupting the existing operational workflow. Overworked staff and complex billing issues compounded the urgency to find a viable solution that would not only stabilize the current situation but also enable planned expansions.

Partnership with Quintessence:

The group’s interim CEO, recollecting his successful partnership with Quintessence from a previous stint, reached out to us and wanted to leverage our extensive experience in orthopedic revenue cycle management to diagnose and rectify the underlying issues. We have over 12 years of specialized experience, managing the revenue cycle for over 25 orthopedic practices, and a dedicated team proficient in eClinicalWorks, makes us a perfect ally for any orthopedic practice.

Strategy and Implementation:

We conducted a comprehensive analysis, identifying key areas such as Medicare reimbursements, coding inconsistencies, and a backlog in denial management.

A 90-day strategic plan was developed, focusing on:

We established a weekly governance meeting with the CEO and heads of RCM, Coding, and AR and an intuitive dashboard was created for real-time progress monitoring. Within three weeks, the tides began to turn. Our meticulous approach led to the discovery of several underlying issues and the implementation of 12 new coding and 18 billing rules. The financial health of the practice started showing signs of recovery.

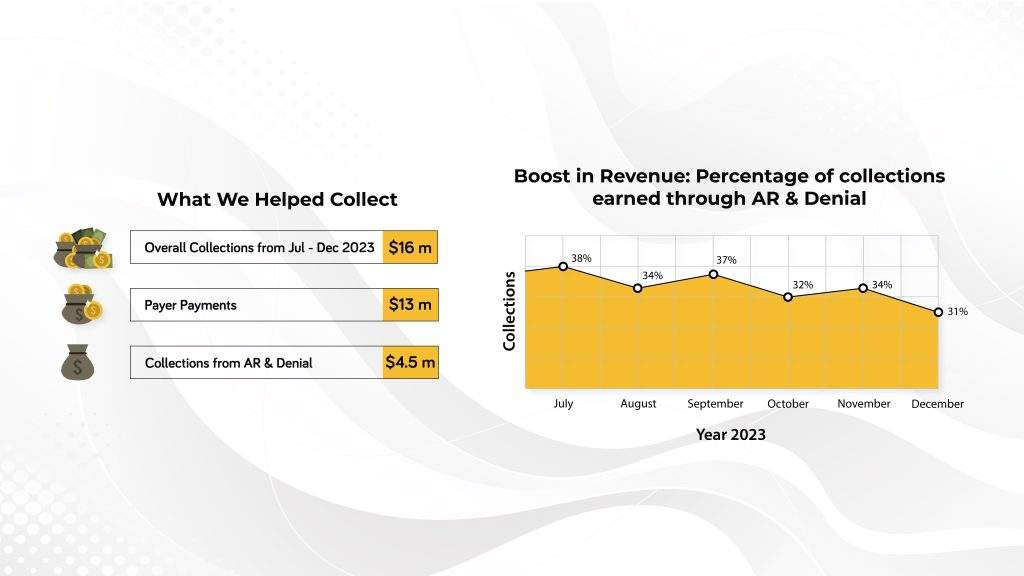

Results:

By January 2024, the concerted efforts led to tangible improvements. The strategic intervention by Quintessence led to a significant turnaround.

Impact:

The strategic intervention resulted in an ROI of 10.8X for the practice. The number of untouched AR claims had plummeted, and the daily denial count had significantly reduced. The group was not only back on track but also poised for expansion. Quintessence’s approach, combining analytical rigor with specialized orthopedic billing knowledge, was instrumental in achieving these results.

This will close in 0 seconds