Our client won a bid for billing and technology services from a 350-doctor multi-specialty group in the Midwest. Here’s how Quintessence helped it’s customer make an impact, with hard facts and numbers

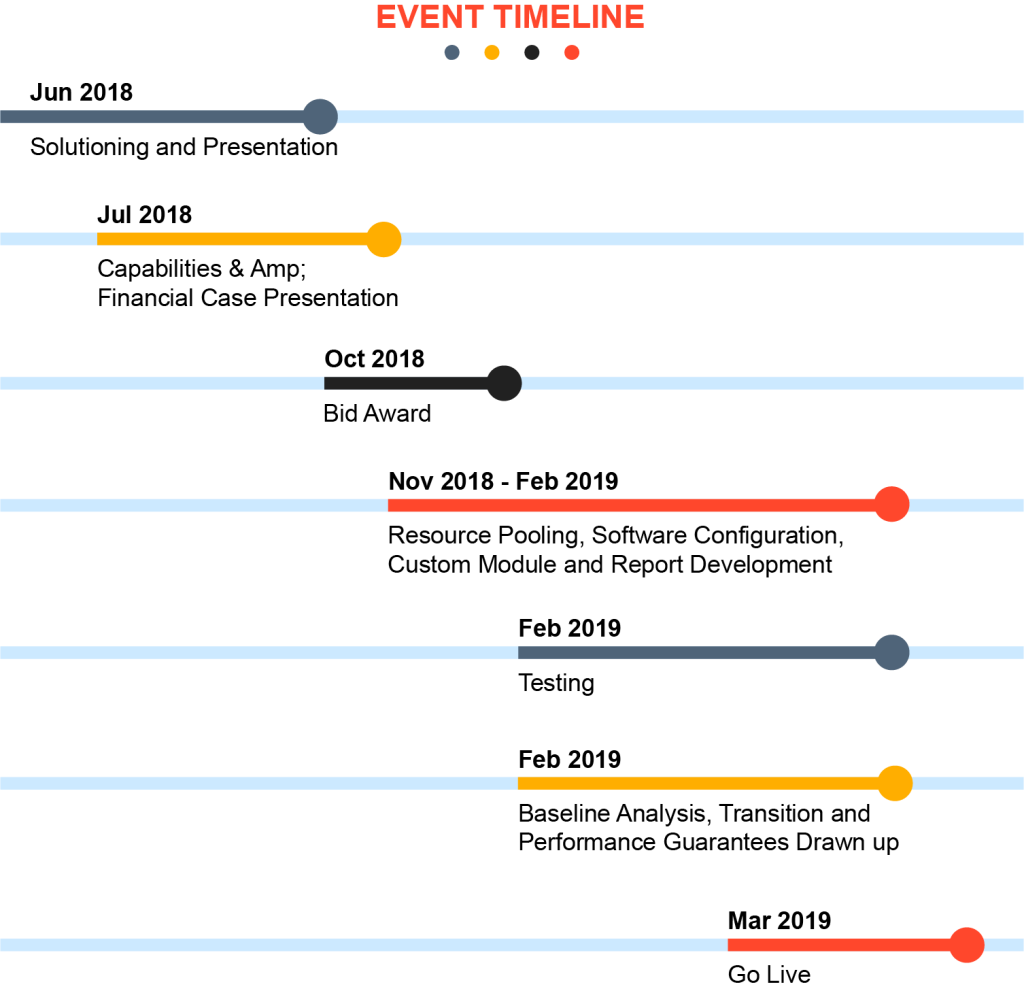

Our client, a large RCM and Tech company, with a nationwide customer base across multiple specialties, brought in Quintessence as its RCM outsourcing partner. When they were reading a bid for a large opportunity, we stepped in to work with the client in the background. We helped fill out the bid documents, pre-sales capability presentations, case studies, financial case and value proposition.

Quintessence and our client set about as a team, recreating the workflows, documentation, billing edits from the last 3 years financial data and payer contracts.To cushion the impact of the switch, we agreed to set up transition guarantees for the first 6 months; and performance guarantees over the next 24 months.

| FY 2017 | FY 2018 | FY 2019 | |

|---|---|---|---|

Mar to Aug |

Mar to Aug |

Mar to Aug |

|

Charges |

$ 109,547,400 |

$ 126,527, 247 |

$ 130,196,537 |

Charges adj for Fee Sch revision |

$ 109,547,400 |

$ 120,502,140 |

$ 118,092,097 |

Collections – Insurance |

$ 26,181,829 |

$ 26,400,922 |

$ 28,329,349 |

Collections – Patient |

$ 3,141,819 |

$ 4,224,148 |

$ 4,249402 |

AR > 90 Days |

$ 29,323,648 |

$ 39,865,393 |

$ 34,278,513 |

Total Receipts |

$ 29,323,648 |

$ 30,625,070 |

$ 32,578,752 |

GCP % |

$ 26.768% |

$ 25.415% |

$ 27.588% |

First Pass % |

$ 91.80% |

$ 91.57% |

$ 92.81% |

Reimbursement per procedure |

$ 109.09 |

$ 108.65 |

$ 110.23 |

Not only were the transition guarantees met, the partners shone with a far better performance. And we are set to meet the financial targets of FY 2020. Quintessence has also taken up physician documentation improvement assignments in a bid to further strengthen compliance and look for possible opportunities to optimize reimbursement.

This will close in 0 seconds